Maximize your

business sale

Maximize your

future

We help owners focus their goals and strategies to maximize the sale of their business, exit high, and live well.

Don’t leave anything on the table.

There is a lot

at stake

90% of business owners’ net worth is tied up in their business — over 50% of business owners will try to sell the company themselves. However, most fail when juggling the day-to-day and leading a successful sales process.

FUTURE RISK

70% of business owners do not know what amount of after-tax income they need to support their lifestyle.

Life's Busy

The average business owner spends over 50 hours a week running their organization, making it almost impossible to manage a successful business sale or transfer of ownership at the same time successfully.

Poor Timing

53% of business owners have not thought through a transition plan, even when two-thirds are over 51 years old.

lack of experience

Buyers want to buy a business, not a job. It takes time and expertise to show prospects the big idea, the potential in your business, and lead them to a great transfer of ownership.

get startedThere is an answer

You need a bullet-proof transition. Capstone Wealth offers the experience and process you need to maximize your business sale, exit high, and live well.

Secure your future

A maximum profit means you can stop dreaming about the future and plan for it. Statistics show that most business owners are unsure what they need to sell their business for in order to live well. With Capstone Wealth, you can put your anxieties to rest.

Tax minimization

Many of our clients are able to reduce their tax obligations by 30 to 80 percent by implementing proven tax-saving strategies in selling their business. We work closely with your advisor team to design and implement strategies that minimize tax consequences in order to maximize the financial resources available to you.

Maximize profit

Why risk leaving potential financial gains on the table when you sell your company? Timing, strategy, and a great partnership improve your chance to reach your long-term goals — leading to a successful exit.

Your Terms

We help you focus on the strategies and techniques that are likely to have the most significant impact on the value of your business to facilitate your ultimate exit on your terms.

Clear strategy & process

Exiting a business has its challenges. Suffering through a clunky exit will be stressful and likely produce less potential profit. Our proactive and straightforward process helps you work through the necessary steps of leaving well, maximizing profits, and easing your anxieties.

Partnership

Our clients win with our national network of tax, legal, and risk management professionals that enhance our team’s expertise.

We will quarterback your professional team to bring the right expertise at the right time.

We’ve been helping business owners for over 30 years.

We understand

You’ve invested a great deal of your life, finances, and energy in establishing and leading a successful company. You and your family have sacrificed to create something unique; it’s time to reap the benefits fully.

We know how hard it can be to take the time to find a great solution to plan your exit, make your business attractive to buyers, and secure your future financial security.

The Capstone Difference

We deliver a multi-year conversation, not a transaction. We help you translate and execute the business valuation results so you can exit high and live well. We will help you highlight the significant aspects of your business while shoring up the areas that could diminish your sale potential.

You owe it to yourself to at least have a conversation about our process. We can help you.

our fees

Prior to working with you, Capstone Wealth will schedule a discovery conversation so we can learn about your expectations for a successful transfer of your business. If we are confident that we can help you achieve your objectives AND you choose to engage Capstone Wealth, we will propose a fixed quarterly fee (typically between $1,250 and $4,000). If our proposed fee is acceptable to you, we will welcome you as a new client and work hard to help you achieve your objectives so you can enjoy a smooth transition to your post-ownership lifestyle.

Special title treatment

With supporting text below as a natural lead-in to additional content.

Special title treatment

With supporting text below as a natural lead-in to additional content.

Special title treatment

With supporting text below as a natural lead-in to additional content.

Special title treatment

With supporting text below as a natural lead-in to additional content.

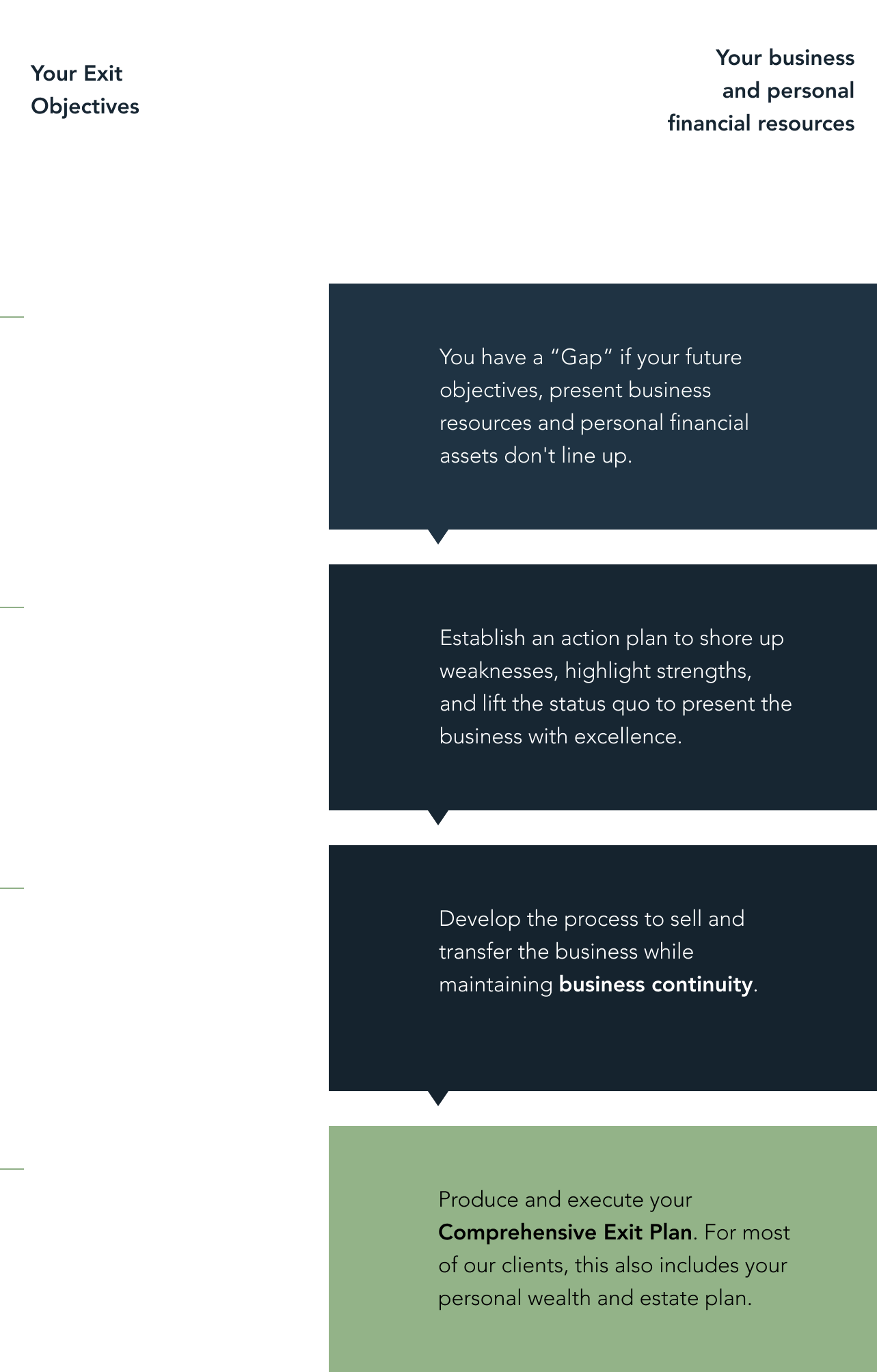

Here is how it works

Our process considers your unique challenges, concerns, and priorities to yield clarity around a more prosperous future.

Our most profitable service to owners is our ability to identify and define what we call “The Gap.“

The Gap is the distance between the realities of your business and your short or long-term needs.

Unfortunately, many owners don’t mind the gap and often miss out on better profits, leaving critical gains on the table. Let’s make your exit process bullet-proof.

Here is a simple way to look at our process.

Certain factors out of your or Capstone Wealth’s control may limit our ability to apply our business exit services, strategies, and methods in a manner necessary to produce a successful outcome:

1. There simply may not be a buyer for your particular business, especially if your business is a niche business that requires specific unique talents and expertise to successfully operate the business.

2. A potential buyer may be unable to secure financing at terms necessary to make the purchase economically feasible.

3. Unfavorable economic forces such as contraction, high-interest rates, elevated inflation, etc., may be present or forecasted at the time you are seeking to sell, causing potential buyers to postpone or delay major purchases.